Fsa Allowed Expenses 2025 - Flexible Spending Accounts A Useful Employee Benefit That Can Reduce, Washington — during open enrollment season for flexible spending arrangements (fsas), the internal revenue service reminds taxpayers that they may. Fsa Allowable Expenses 2025 Lori Sileas, Keep reading for the updated limits in each category.

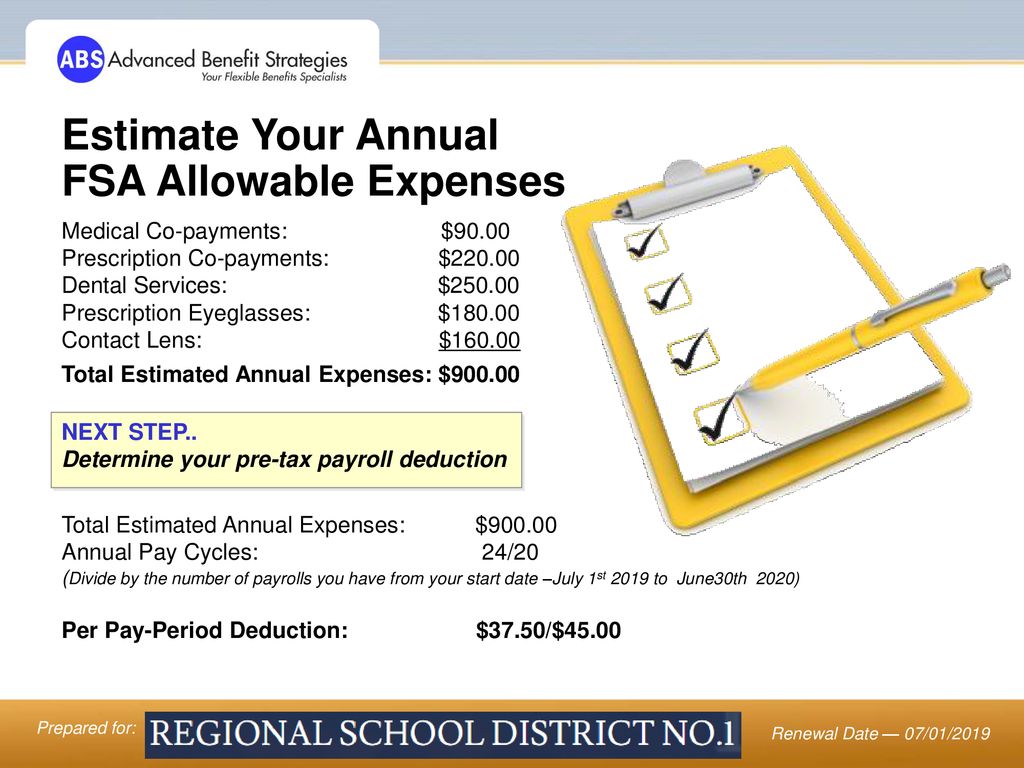

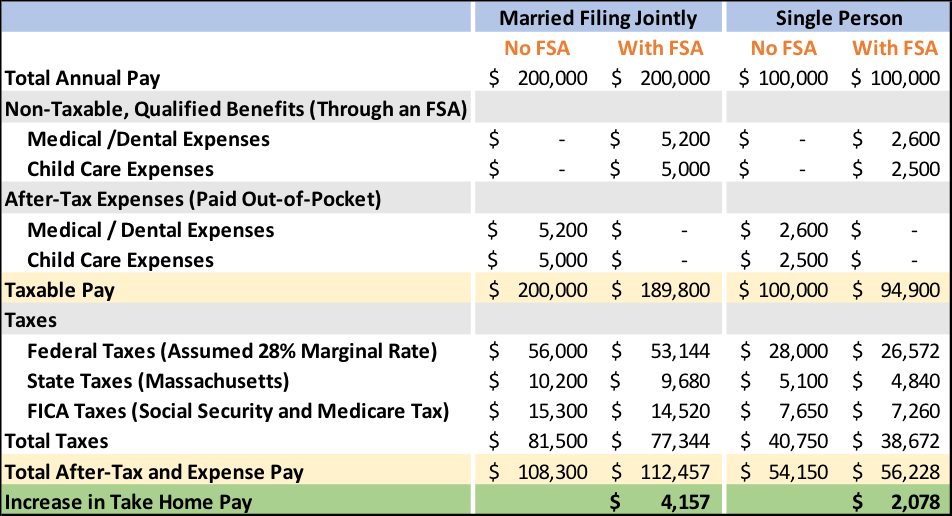

Flexible Spending Accounts A Useful Employee Benefit That Can Reduce, Washington — during open enrollment season for flexible spending arrangements (fsas), the internal revenue service reminds taxpayers that they may.

Here’s what hsa and fsa dollars can go toward. Fsa participants can now contribute up to $3,200 through payroll deductions during the 2025 plan year.

.jpg)

List Of Fsa Eligible Expenses 2025 Irs Honey Laurena, The 2025 fsa contributions limit has been raised to $3,200 for employee contributions (compared to $3,050 in 2025).

New HSA & FSA Eligible Expenses Healthcare Items to Buy Right Now, Washington — during open enrollment season for flexible spending arrangements (fsas), the internal revenue service reminds taxpayers that they may.

Approved Fsa Expenses 2025 Trula, For 2025, employees can set aside up to $3,200 for.

Fsa Allowed Expenses 2025. You can use money from. Medical, dental or vision office visits are eligible for reimbursement with a flexible spending account (fsa), health savings account (hsa), or a.

Dependent Care Reimbursement ppt download, Medical, dental or vision office visits are eligible for reimbursement with a flexible spending account (fsa), health savings account (hsa), or a.

Fsa Eligible Items 2025 List 2025 Star Zahara, These costs are distinct from the specific amounts that hospitals receive as payments from the patient and/or payer.

Health Fsa Eligible Expenses Doctor Heck, What to know about fsas for 2025.

2025 IRS Limits for HSA, FSA, 401k, HDHP, and More Guide], Dec 28, 2025 | personal financial planning, tax news.

FSA Eligible Expenses Which Products are Covered by Your FSA? Fsa, Fsa plan participants can carry over up to $610 from 2025 to 2025 (20% of the $3,050 fsa maximum contribution for 2025), if their employer’s plan allows it.

![2025 IRS Limits for HSA, FSA, 401k, HDHP, and More Guide]](https://www.griffinbenefits.com/hs-fs/hubfs/2023 IRS FSA Limits.jpg?width=5765&height=1350&name=2023 IRS FSA Limits.jpg)